The Attorney General's Office encourages non-profit organizations to maintain their viability to serve the public good. It provides information that organizations can use to develop capacity and comply with applicable laws. This office is also the administrator of the Charitable Advisory Council. The Attorney General has resources that organizations can tap to employ best practices for sustainability and adherence to the law.

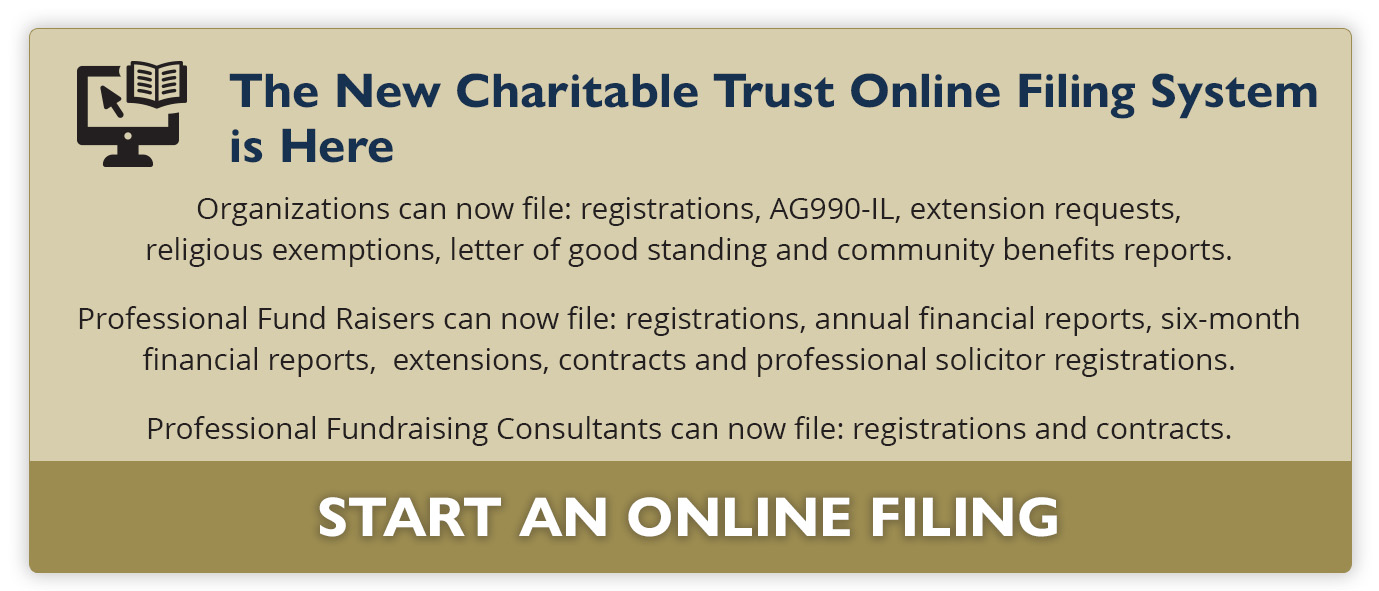

Charitable Trust Online Filing System

Attorney General Raoul’s new online filing system for charitable organizations launched in August

2025. The platform is an easy-to-use portal to conveniently prepare and submit required filings.

Watch these videos to learn how to get started.

Charitable Trust Portal Tutorial:

Annual Report (AG 990-IL)

Charitable Trust Portal Tutorial:

Extensions

The Attorney General’s Office offers periodic training webinars on charitable trust issues including how to use the new Online Filing System. Please email Special.Events@ilag.gov to request to be added to the Charitable Trust distribution list for information on future webinars.

Donating with Confidence and Making Wise Charitable Decisions

Charitable giving addresses many needs. Nonprofit organizations harness their mission-driven energy and donations to respond and react to numerous and sometimes dire circumstances.

- Protects the giving community from potential fraud and defends the public trust

- Upholds legal safeguards in place to ensure that charitable causes meet their financial responsibilities

- Registers organizations that receive donations

- Provides information on charitable organizations' resources and responsibilities.

Because Illinoisans rely heavily on the services provided by charities, Attorney General Kwame Raoul encourages consumers to practice wise charitable giving.

All charitable organizations that solicit donations or hold charitable assets in Illinois are required to register with Attorney General Kwame Raoul's Office.

Members of the public can check the online Charitable database to search if a charity or private foundation is registered and compliant with reporting requirements.

The database provides financial information such as assets, income and annual financial reports. Do your research, give to organizations that you are confident in and don't hesitate to say No Thanks if a solicitation does not feel right.